Interest rates for a 30-year fixed rate mortgage climbed consistently throughout 2018 until the middle of November. After that point, rates returned to levels that we saw in August to close out the year at 4.55%, according to Freddie Mac’s Primary Mortgage Market Survey.

After the first week of 2019, rates have continued their downward trend. As Freddie Mac’s Chief Economist Sam Khater notes, this is great news for homebuyers. He states,

“Mortgage rates declined to start the new year with the 30-year fixed-rate mortgage dipping to 4.51 percent. Low mortgage rates combined with decelerating home price growth should get prospective homebuyers excited to buy.”

Every year around this time, many homeowners begin the process of preparing their homes in case of extreme winter weather. Some others skip winter all together by escaping to their vacation homes in a warmer climate.

For those homeowners staying at their first residence, AccuWeather warns:

“The late-week cold shot should fade next week, but this is a warning shot for winter’s return late in the month and early February.”

Given this, it’s time to go and stock up on winter weather supplies! However, if you’re tired of shoveling snow and dealing with the cold weather, maybe it’s time to consider obtaining a vacation home!

According to the Investment & Vacation Home Buyers 2018 Report by NAR:

“72% of vacation property owners and 71% of investment property owners believe now is a good time to buy!

Some Highlights:

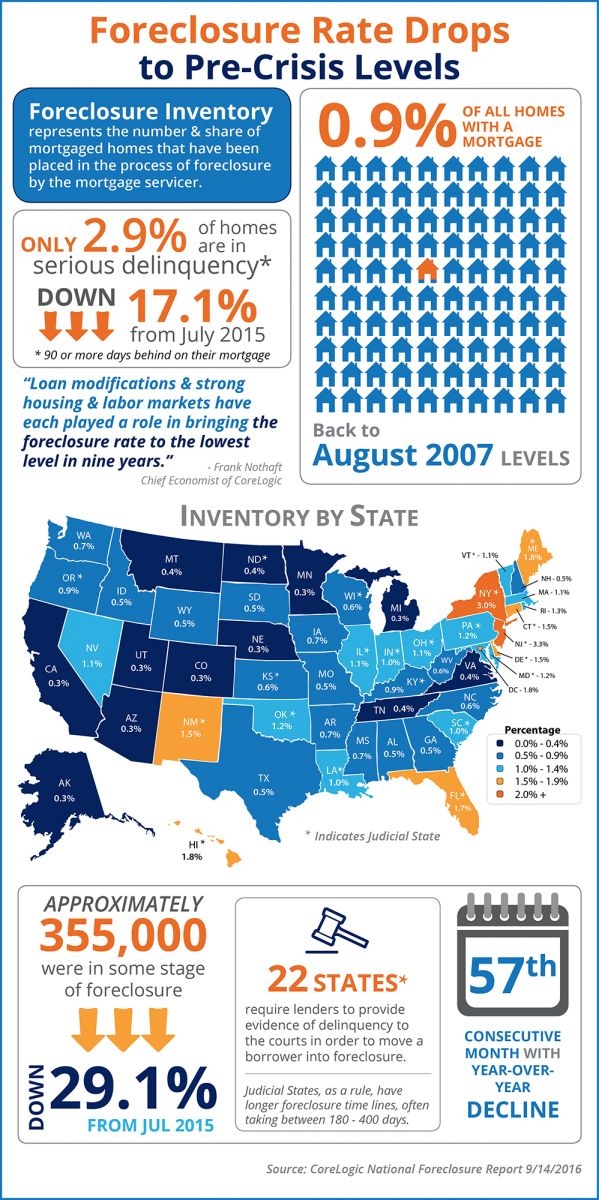

Only 2.9% of homes are in serious delinquency, down 17.1% from July 2015.

This is the 57th consecutive month with a year-over-year decline.

The national foreclosure rate has returned to August 2007 levels, at only 0.9%.