Study after study shows that no matter what generation Americans belong to, the vast majority believe that homeownership is an important part of their American Dream. The benefits of homeownership can be broken into two main categories: financial and non-financial (often referred to as emotional or social reasons.)

For Americans approaching retirement age, one of the greatest benefits to homeownership is the added net worth they have been able to achieve simply by paying their mortgage!

The Joint Center for Housing Studies at Harvard University focused on homeowners and renters over the age of 65. Their study revealed that the difference in net worth between homeowners and renters at this age group was actually 47.5 times greater, with nearly half their net worth coming from home equity!

Every year around this time, many homeowners begin the process of preparing their homes in case of extreme winter weather. Some others skip winter all together by escaping to their vacation homes in a warmer climate.

For those homeowners staying at their first residence, AccuWeather warns:

“The late-week cold shot should fade next week, but this is a warning shot for winter’s return late in the month and early February.”

Given this, it’s time to go and stock up on winter weather supplies! However, if you’re tired of shoveling snow and dealing with the cold weather, maybe it’s time to consider obtaining a vacation home!

According to the Investment & Vacation Home Buyers 2018 Report by NAR:

“72% of vacation property owners and 71% of investment property owners believe now is a good time to buy!

Some Highlights:

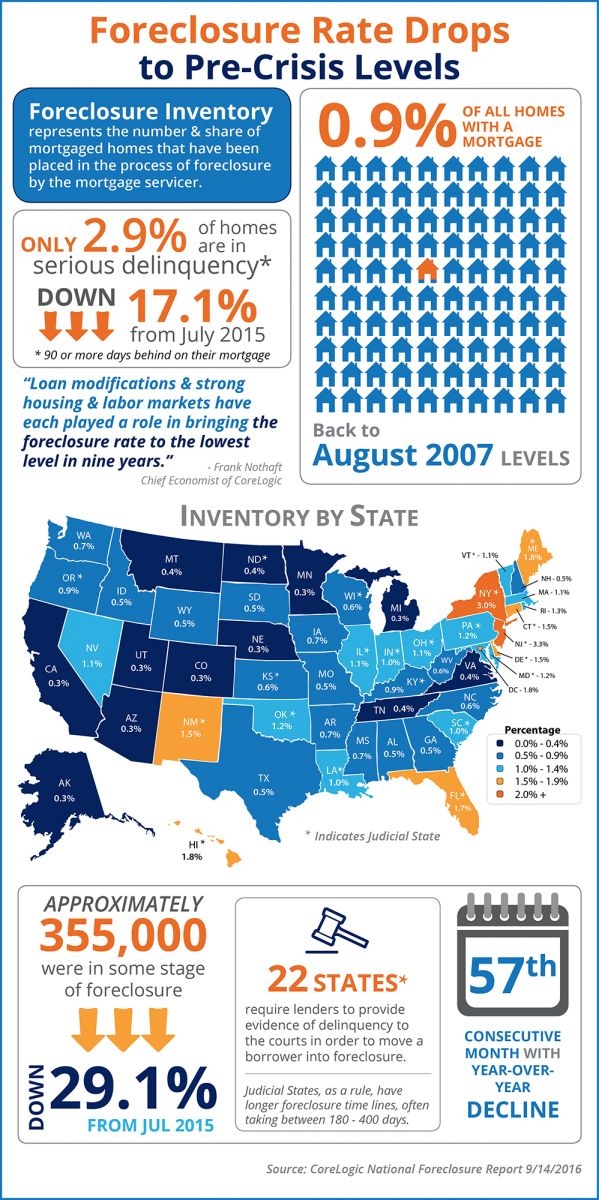

Only 2.9% of homes are in serious delinquency, down 17.1% from July 2015.

This is the 57th consecutive month with a year-over-year decline.

The national foreclosure rate has returned to August 2007 levels, at only 0.9%.